In the intricate landscape of finance, understanding the various forms of debt is crucial for investors and businesses. Among these, senior debt holds a unique and significant position. This article will explore senior debt, its examples, types, hierarchy and its implications for investors. Additionally, we’ll explore how a senior debt loan provided by experts can play a pivotal role in an investor’s financial strategy.

Table of Contents

Toggle

What is Senior Debt?

Senior debt is a term that resonates across different industries, from corporate finance to property and plays a central role in capital structures. At its core, senior debt represents a level of debt that holds a primary claim to repayment compared to other forms of debt in the event of default, bankruptcy or the liquidation of assets. It’s often referred to as “senior” because it takes precedence over other debt obligations, securing its place as the first line of repayment.

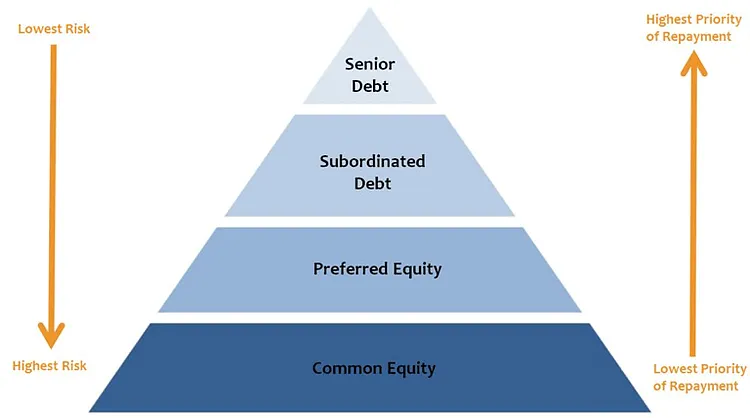

To illustrate, envision a company’s capital structure as a layered pyramid. The top layer is occupied by senior debt and it’s from this layer that lenders are repaid first when the financial entity faces a crisis or enters insolvency proceedings. This priority position makes senior debt an appealing option for lenders, as it enhances the likelihood of recovering their invested capital.

Types of Senior Debt

Senior debt can take on various forms, with each type tailored to the specific needs and preferences of the borrower and the lender:

- Senior Secured Debt. This type of senior debt is secured by specific assets that serve as collateral. In the event of default, the lender has the right to seize and liquidate the collateral to recover the debt amount. This security makes the senior secured debt less risky for lenders.

- Senior Unsecured Debt. Unlike secured debt, senior unsecured debt lacks collateral. Lenders rely on the borrower’s creditworthiness and financial standing to ensure repayment. Because there’s no collateral, interest rates might be slightly higher.

- Senior Convertible Debt. This form of senior debt offers added flexibility. It allows the lender to convert the debt into equity at a predetermined rate, usually benefiting both the lender and the borrower.

Understanding senior debt’s intricacies is essential for investors and borrowers, as it shapes the dynamics of financial transactions and investment decisions. In the following sections, we’ll explore the hierarchy of senior debt, its position in the debt seniority table and how senior debt loans can be leveraged for financial strategies.

Source: Corporate Finance Institute, November 2022. ”Senior Debt”

Debt Seniority Table

A debt seniority table outlines the ranking of various debts in terms of repayment priority. At the top of the table, you’ll find senior debt. Below it, there may be other levels, like subordinated debt and equity. Below, we will explore the debt seniority hierarchy.

Debt Seniority Hierarchy

Understanding the hierarchy is crucial, especially when considering investment opportunities. In a typical debt seniority hierarchy:

- Senior Debt stands at the top, ensuring that these lenders are repaid before other debt holders.

- Subordinated Debt, also known as junior debt, is a lower priority for repayment than senior debt.

- Equity holders are last in line for repayment. If a company faces liquidation, equity holders are the ones who receive any remaining funds after all debts are settled.

Senior Debt Examples

Let’s put this concept into context with a few examples.

- Corporate Bonds

In the corporate realm, senior debt commonly takes the form of bonds. When a company issues bonds to raise capital, senior bonds are given preference in repayment. If the company faces financial distress, senior bondholders are the first to receive repayment before other classes of creditors.

- Mortgages

Senior debt in property financing refers to the primary mortgage on a property. When the property is sold, the lender holding the senior mortgage is entitled to be repaid before any junior lenders or other creditors.

- Bank Loans

In banking, senior loans are often secured loans, meaning they are backed by collateral. If the borrower defaults on repayment, the lender has the right to claim the collateral to recover the outstanding debt.

A Real-World Example of a Senior Debt

An experienced property investor is eyeing a promising commercial property in the city. The property has immense potential for generating rental income due to its prime location and high demand. The investor decides to secure a mortgage from a lending institution to finance the purchase.

- Property Purchase.

The commercial property is listed for £2 million and they plan to put down a 20% down payment (£400,000). The investor approaches a bank for a mortgage to cover the remaining £1.6 million.

- Senior Debt in Property.

In this scenario, the mortgage the investor obtains to finance the property purchase represents senior debt in the real estate market. The mortgage lender provides the investor with the funds needed to acquire the property, and in return, the lender places a lien on the property as collateral.

- Repayment Priority.

Suppose, in the future, the investor faces unexpected financial challenges that make it difficult for the investor to make mortgage payments.

If the investor defaults on the mortgage, the property could go into foreclosure. However, because the mortgage is classified as senior debt, the lender has a higher priority for repayment than other creditors.

If the property is sold through foreclosure, the proceeds from the sale would be used to repay the mortgage lender first, ensuring that they recover their loan amount. Any remaining proceeds, if available, would then go to other junior creditors or equity holders.

- Impact on Investors.

For the investor, the senior debt in the form of a mortgage allows the investor to secure the property and generate rental income. It also means that the lender has a priority claim to repayment if the property’s ownership is jeopardised due to default.

For the lender, the mortgage classification as senior debt provides security, increasing their confidence in lending funds to property investors like this one.

Senior Debt Loans

When it comes to leveraging senior debt in your financial strategy, having a reliable partner is essential. This is where Novellus can come into play. As experts in the field, the Novellus team provides senior debt-bridging loans that empower businesses and investors.

Senior debt loans from Novellus offer:

- Reliability. Count on us as your primary source of financing, ensuring your needs are met before other creditors.

- Security. Backed by collateral, our senior debt loans provide a secure financing option.

- Flexibility. Our tailored solutions cater to the unique requirements of your industry and investment goals.

- Expertise. With our experienced team, you will always be in capable hands receiving guidance throughout the process.

In the complex financial landscape, senior debt offers security for lenders and borrowers. Understanding its significance and implications can help investors make informed decisions. Whether it’s corporate bonds, real estate mortgages or tailored senior debt loans, the priority position of senior debt can make a significant difference in financial strategies. At Novellus, we’re dedicated to providing you with the expertise and support you need.

If you are a seasoned investor seeking swift and flexible financing solutions for your property ventures, Novellus offers specialised senior debt bridging finance designed to empower your investment strategies so fill in the quick enquiry form below to find out more.