Since 2020, the COVID-19 pandemic has been affecting virtually every aspect of life in the UK. From rising prices and supply chain disruptions to travel restrictions and the real estate market – people are adapting to the new normal and finding ways to protect their savings.

The cost of living in the U.K. surged in October to a 10-year high, with the figure now more than double the target set by the Bank of England. The Bank of England expects inflation to rise further to around 5% in the spring of 2022 before falling back toward its 2% target by late 2023, as the impact of higher oil and gas prices fades and demand for goods moderates.

For this reason, investors are looking for ways to reduce inflation by investing in property. In times of economic instability and market volatility, real estate is a safe haven for your money. You can purchase property to let it out for extra income or wait for it to appreciate in value and sell at a profit.

Real Estate Income

Real estate income is the income you earn from renting out a property. Buy-to-let schemes work well during periods of high inflation. This is usually because there is a dip in the real estate market and you are able to buy a suitable property for cheaper than its normal price. At the same time inflation rises, so do rent rates and you can charge a higher rent from tenants. As a landlord, you can end up earning a higher rental income over time. This helps to keep pace with the rise in inflation.

This makes real estate income one of the best ways to hedge an investment portfolio against inflation.

There are several pros to investing in real estate to reduce the effects of inflation on your finances.

Appreciation Value

One of the most beneficial aspects of real estate is appreciation. Property values appreciate between 3% and 5% annually, on average. In some markets, like London, Edinburgh and Dublin, we have observed appreciation rates anywhere between 6% and 10%, depending on the year. To illustrate, if you buy a house for £100,000, assuming an annual appreciation of 6%, you’d have a property valued at £179,000 in just 10 years. Even at a more conservative 4%, the property would be valued at £148,000. Comparing it to inflation, from 2009 to 2019, there was roughly a 19% rate of inflation meaning your £100,000 purchase would cost you£119,000 to buy it again in 10 years.

Such an investment means you not only keep up with inflation through real estate investments, but you can add value and gain appreciation by investing in property.

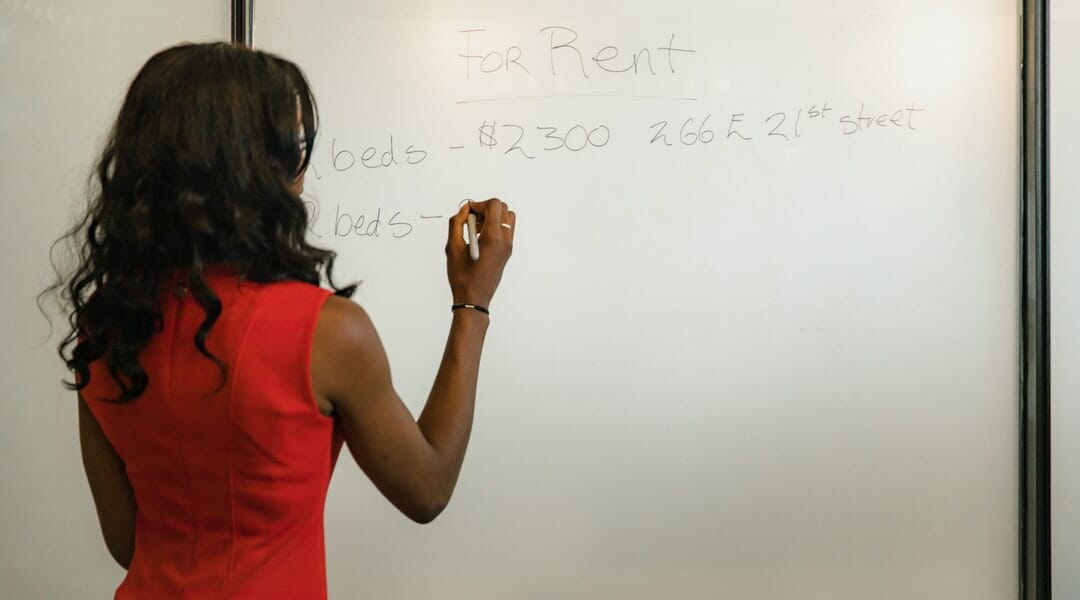

Increasing income (rents)

Owning property means that you can use it in a buy-and-hold strategy and generate cash flow from tenants. An investment in rental property will not only cover your monthly expenses, but will also generate £400-£1,000 per month in cash flow. If you manage your rent property wisely, you can garner rent increases annually generating even more cash flow than your original investment.

If you have a property that generates £1,000 in rent per month, an increase of only £20 per year, in 10 years, you’d be receiving an additional £200 per month in cash flow. Naturally, you need to factor in expenses like taxes and insurance as those increase over time as well. However, your increased rental income will help to cover those expenses as well as add additional cash flow for you.

Given the trend of increasing rents, you’ll be protected from the inflation that may affect your taxes, insurance and maintenance costs.

Depreciating debt

As your real estate appreciates in value, your debt owed on the property depreciates in value with the rate of inflation. How can this be? Let’s consider a £750 mortgage payment in year one is worth £750. However, in 10 years, with inflation, that debt is going to be worth less. For consistency, we will use the 2009-2019 inflation rate. If your payment is worth £750 in 2009, by 2019, it will only be worth about £640 due to inflation.

When you use leverage, or financing, to invest in real estate, you are essentially taking advantage of depreciating debt. Yes, your monthly payment will stay the same. You need to make the same $750 payment per month year after year (assuming a fixed-rate loan). But, the value of that payment will decrease over time.

Conclusion

Despite the economic uncertainty and high levels of redundancies during 2020, the rental market remains strong according to a report published by the Royal Institute of Charter Surveyors (RICS) in September. As such, a buy-to-let (BTL), especially outside London, may be a good investment opportunity.

Inflation is inevitable. It either happens at a high rate, a steady rate or somewhere in between. Even during an economic downturn as was the period between 2009 and 2012, the inflation rate still averaged around 2%.

One of the best ways to fight inflation, and secure your finances in the long run is through inflation hedge investments such as buy-and-hold or buy-and-let real estate properties.